I spent the end of my day typing up a script for the weekly hold message when you dial in to the 800 number. Since it is a recap of the market this week, and a look ahead, I figured I would post it and see if anyone would get any use out of it. I hope you all have a great weekend, and I will see you back here on Monday.

Hello fellow traders, thank you for calling INVESTools. My name is Jeff Kohler. You might recognize my voice from our advanced trading room sessions where I teach Price Patterns, Credit Spreads, and Options Pricing and Volatility. I also present Master Talk, which is a weekly event that takes place every Wednesday night. In this event we discuss theories and applications that are cohesive with the current market environment.

I am here this week to discuss our current trading environment and to provide a short term forecast on the market. Let’s start with a recap of last week.

It was a wild ride this week as we saw prices rise and fall all over the board. Earlier this week the market rallied behind the Fed’s decision to keep interest rates unchanged at 5.25%. However, shortly thereafter we witness a counter-Fed decline as the Federal Reserve Bank of Philadelphia released a report showing that Mid Atlantic manufacturing fell to a negative valuation for the first time in three years. This left Wall Street in a state of concern that the economy might be slowing more than was anticipated. Just as we came close to all time highs, the Dow closed out the week at 11508, down .46% percent this week, while the NASDAQ closed at 2218, down .75% percent as of week end.

Bond prices have risen sharply as the 10 year note has been dropping like a rock. Bond traders seem to be making the bet that the slowing economy would make future rate increases unnecessary. With the steep drop we’ve witnessed in interest rates perhaps bond traders are betting that the Fed may DROP rates in the near future.

This predicament is also putting pressure on the dollar. The EUR/USD pair has broken out of a recent basing pattern offering currency traders a chance to profit on a potential rise in the pair to prior annual highs.

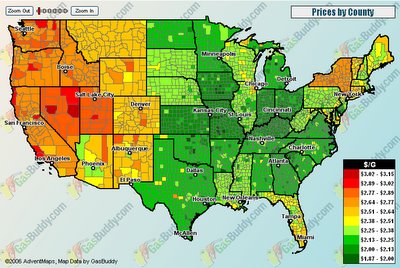

In commodity related news we have seen the price of oil plummet 4 percent this week. Only a few weeks ago the price of oil was nearing the $80 per barrel range, and as of Friday, Light Sweet Crude for November delivery finished the week at $60.27 a barrel. Analysts suspect that a continued drop in the price of oil is feasible; at least until winter demand starts to rise. The supply of oil remains high, and if we see a mild winter this year, there will less demand than anticipated.

As we look ahead…what is expected out of the market this week? The market is fearful that the economy is cooling off more than expected, so keep an eye on this weeks upcoming economic reports. The reports with the greatest potential impact for this week are New & Existing Home Sales, Consumer Confidence, and Chicago PMI. If any of these reports confirm wall streets concerns, you could see the market averages continue to fall.

As we work our way through September, remember what is just around the corner in October. This is where most companies will be announcing earnings. October is normally referred to as earnings season for this very reason. If corporate profits are down, this could weigh heavily on the markets decision to advance or decline. For this very reason I want you all to be paying close attention to the Volatility Index (symbol VIX.X in the corporate snapshot section of the toolbox). You will see that volatility is relatively low, which is a concern for market contrarians. If you see the VIX gradually start to rise, then option premiums will gradually start to rise along with it. If you are holding options during this rise, this will add to your profits, and help to offset losses.

Speaking of option volatility, this would be a great opportunity to welcome THINK or SWIM to the INVESTools community. In case you have not heard we have partnered with thinkorswim—one of the industry’s top online brokerages ranked “best for option traders” by Barron’s magazine. Think or Swim offers our students the best available trading tools and rock bottom commission rates. If you haven’t seen the announcement yet, go to the Toolbox and click on the thinkorswim banner ad at the top of the page to read all about it.

Using the ThinkorSwim platform, you can view your current option positions and modify your current implied volatility on these positions. For example, if I am expecting general market volatility to rise, I can increase the volatility values on each position I own to get a theoretical valuation of what the premiums might look like if this were to happen. If I want to get more in depth, I can run my option through a probability analysis to see what the likelihood of profitability is. Risk graphs to determine max gain, max loss, or breakeven points within your trades. Their analytics are the best in the business.

As next week unfolds, there are a few things I want you to keep a close eye on. If you are bearish on the market I would keep an eye on the Capital Goods/Construction & Agricultural Machinery group (symbol .CAM) This group has been working its way to the bottom of the list. Within this group you fill find stocks such as Caterpillar (symbol CAT) and Joy Global (symbol JOYG) breaking strong levels of support. This kind of movement generally signals a great opportunity to short shares of stock or purchase put options as prices attempt to find new lows.

If you are bullish on the market and are looking for a few bread winners to carry throughout a turbulent week, I would strongly suggest watching the Health Care Facilities group (symbol .FHF). Here you will find several strong fundamental companies in strong upward trends. The top prospects here would be Amedisys (symbol AMED), Psychiatric Solutions (symbol PSYS), Davita (symbol DVA), and Manor Care (symbol HCR). These companies are leaders in their group and are close to yielding buy signals.

I hope you have found this information useful. We have discussed a list of things to keep in mind as the week progresses. Continue to stay positive and focused on your goals and the task at hand. Be diligent and thorough in your analysis, and most importantly, stay disciplined to your rules! I wish you the best of luck this week. Happy Trading.

To Amber, the love of my life I want to wish you a Happy Birthday. I hope your day is the best it can be. I love you to death, and want to thank you for being such a wonderful wife, mother, and the best friend I have ever had. I appreciate all the love, friendship, and support you have given me. Three Cheers For AMBER!!! I love you!

To Amber, the love of my life I want to wish you a Happy Birthday. I hope your day is the best it can be. I love you to death, and want to thank you for being such a wonderful wife, mother, and the best friend I have ever had. I appreciate all the love, friendship, and support you have given me. Three Cheers For AMBER!!! I love you!

To send me a suggestion on what you would like to read about.

To send me a suggestion on what you would like to read about.

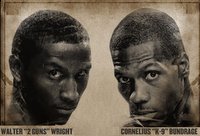

In my opinion, "K9" who was lucky to be there, was the least skilled fighter of the litter. He is one of the strongest, if not the strongest person in contention though. His strategy was to get into his opponents head and to shake their ability to focus. His opponent Walter, was near the top of the list in skill. He had a lot of confidence, very finesse, and knew how to win fights. He was very good at what he does.

In my opinion, "K9" who was lucky to be there, was the least skilled fighter of the litter. He is one of the strongest, if not the strongest person in contention though. His strategy was to get into his opponents head and to shake their ability to focus. His opponent Walter, was near the top of the list in skill. He had a lot of confidence, very finesse, and knew how to win fights. He was very good at what he does.