A Comprehensive Guide to the Black Scholes Calculator

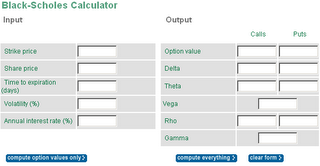

In the meantime, I will attempt to provide a "teaser" on the functionality of this tool, and a few ways it can be useful. This may generate a few questions and I will try to be as thorough as I can be. Let's start with a picture of the model. To get there click the "black scholes calculator" link located on the left hand side of your stocks Corporate Snapshot. Here is a picture of what you will be working with...

What made this model so popular was the limited number of inputs, and relatively simple math equation to produce values. I'm not touching the math tonight, just where to get the appropriate data to get started. You have five inputs you need to fill to get your price, let's discuss the details...

1. Strike Price- Any questions on where to find this? Good, let's move on.

2. Stock Price- Jeez...this is getting complicated!

3. Time Til Expiration- Slightly more challenging, I must admit. If you dare send me an e-mail asking where to find this information, I might be tempted to reply to you with a computer virus attached. JUST KIDDING. If you don't really want to count, go to the Options Greeks page and click on T-VAL next to the option in question. In the upper left hand corner you will see "days til expiration."

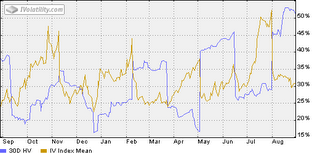

4. Volatility- Now it's getting interesting. If you don't fully understand implied volatility yet, click here. (I love to hyper-link myself!) To get volatility information, I will click on MY LINK to the CBOE on the right hand column of my blog. Let me also inform you that there are several ways to get the volatility figure for this calculation. You can also retrieve it from the greeks page, or the volatility page on the toolbox. I prefer CBOE since I can see a chart of volatility and read it's trend, which we have already discussed in the past. Anyway, when you get there type in the symbol of your stock. Once you have done that, there will be a thumbnail chart on the right hand side that says "volatility chart." When you click on it, you should see something like this...

All you will really need is the current "IV Index Mean" which is the current average implied volatility. Plug this figure into the calculator.

5. Annual Interest Rate- To get this figure, type in symbol IRX.X on the corporate snapshot, or $IRX on the Interactive Chart to get the current value. As of tonight, 4.92.

Now you should be able to click "calculate everything" and get not only the theoretical option value, but also theoretical greek values as well. "But Jeff...Why would you do this when all you have to do is look at the ask price to get the current option value lol?" Let me explain, I do not do this to get a current valuation. I prefer to use this to get an idea of what my option would be worth if the stock price moved...or if time has decayed...or if volatility has moved. Use this to create different "what if" scenarios. As I anticipate certain movements in the stock price, I will input my projected stock price...I will input the change in volatility I am expecting...and subtract how much time I expect this to take...and wahlah! I now have a theoretical value of what my option should be worth if this all goes as planned. Sweet!!!

HOMEWORK: Practice this concept. I want you to do two different calculations. One for an ITM option, and one for an OTM option. Here are you parameters.

ITM- Strike 50, Stock Price 55, Time 45, Volatility 30, IR 4.92.

OTM- Strike 60, Stock Price 55, Time 45, Volatility 30, IR 4.92.

Try these experiments. On each calculation, try to factor a $6 price move. Ex: change stock price from 55 to 61. Subtract 15 days in which it took this movement to happen. Compare the % returns for an ITM vs an OTM.

Next, go back to the original parameters, and factor a loss in price. Let's say a loss of $3 per share. Ex: change stock price of $55 to $52. Subtract 15 days in which it would have taken this to happen. Compare % losses for an ITM vs an OTM.

Finally, I want you to practice tweaking volatility a little. Do it in a realistic fashion. Try changing a volatility of 30 to 40. Run a few different scenarios until you feel more comfortable with how these different puzzle pieces and their changes affect that option price.

I know this might be challenging at first, but read this a few times and  experiment a little until its becomes clear. If not, get into my trading room session where we can discuss this in explicit detail.

experiment a little until its becomes clear. If not, get into my trading room session where we can discuss this in explicit detail.

.

.

Now I am off to bed...I can't believe I am still awake.

Jeff, The fog is finally begining to clear. Great example. When using these examples,it seems OTM is the way to go, so why then does Investools always teach ITM. I know its more conservative,but why not teach both? And what about ATM? Sarah

Posted by Anonymous |

8/31/2006 09:14:00 AM

Anonymous |

8/31/2006 09:14:00 AM

Sarah...

Careful what you wish for! Remember to think in terms of probabilities. Which trade has a higher probability of success? Can you stomach being wrong more often with OTM option vs. ITM options? There are pro's and con's in every strategy, but INVESTools steers clear from this since you have a much lower probability of success. However, as you can see when you are right you have a greater reward potential!!! If you are thinking about joining the darkside with me, than I would papertrade this first until you find a groove. Hope this has been helpful!

Jeff

Posted by Option Addict |

8/31/2006 09:54:00 AM

Option Addict |

8/31/2006 09:54:00 AM

Hi Jeff - Thanks so much for all your educational insights! I though I would share with some of you readers a "good news" trade i made today: I was up early and heard the announcement of the GG acquisition of GLG this morning so I placed a BMO order for GLGIH Sep 40 Call at limit of $2.00. I got 5 contracts for $514.95. The stock gapped open up $7.00 and by the time i got to work i still managed to capture a 528% profit selling the call for $6.50 netting $2720!

It just goes to show opportunities are there and announcements can still be traded effectively. Thanks again for all your help in my education!

TPlus1

Posted by Anonymous |

8/31/2006 09:58:00 AM

Anonymous |

8/31/2006 09:58:00 AM

I love good news.Way to go!! I need to start getting up early!

Posted by Anonymous |

8/31/2006 11:05:00 AM

Anonymous |

8/31/2006 11:05:00 AM

I am confused as heck about how differences in Vega, Delta, theta, etc affect the options. I hope it comes to me quickly because it is getting frustrating. I will be getting access to the Advanced Options Trading rooms hopefully before the weekend so I hope to get some education on this over the weekend.

Now to my question...In several of the Master's Talk sessions the Instructors mention that not all stocks follow the trend of the market. What stocks are they talking about? Everyone says the trend is your friend so I was interested in what stocks/indexes/industry groups don't follow the trend.

Posted by Anonymous |

8/31/2006 01:30:00 PM

Anonymous |

8/31/2006 01:30:00 PM

Brenda,

Think of it this way...do you know of any stocks that are uptrending? Probably many right? How about downtrending? Sure, probably a fe of those also. The market is in the middle of an intermediate uptrend right now...so all those downtrending stocks are trending against the market! There are plenty of stocks that will move up or down regardless of the market on their own merit.

In respose to your confusion on greeks, if you have't studied them before, then this is natural. When I went to a biomedial conference a few weeks ago, and they threw out terms on how methyllation works along with neurological symptoms, I giggled. I had no idea what the hell anyone was talking about. But since I have an underlying reason to figure this out, I studied it. It will come in time, just work on the definitions first, then the application. Once you get into advanced options, you will do just fine!

Posted by Option Addict |

8/31/2006 02:00:00 PM

Option Addict |

8/31/2006 02:00:00 PM

TPlus1,

How did you get in on your options before the market opened? Did you just put in an order for the open? Great luck and a great return. Congratulations!

Debbie

Posted by Debbie Davis |

8/31/2006 03:47:00 PM

Debbie Davis |

8/31/2006 03:47:00 PM

Hi Debbie,

Yes, I just placed the order with the broker prior to the market opening since I had to leave my workstation before opening bell. I used a limit order since I was fearful of orders stacking up and running the price of the option up too high before filling my order. I choose a limit of $2.00 because that was what I was willing to get in at and still felt it would be profitable; the option price was $1.00 and that is what I happened to fill at when the market opened. Had I been there to watch the open I could have sold at or near $7.00 for the opiton and made nearly 700% return, but by the time I got back to my PC some retracing had already begun. Hope this is helpful - happy trading!

TPlus1

Posted by Anonymous |

9/01/2006 08:41:00 AM

Anonymous |

9/01/2006 08:41:00 AM

Jeff,

When you say you teach a class on option pricing are you talking about advanced options trading room or in the advanced option course?

Posted by Anonymous |

9/01/2006 02:18:00 PM

Anonymous |

9/01/2006 02:18:00 PM

Jeff, I was playing with the Black-Scholes calculator and ran into an interesting situation. I was just trying to change only the share price in intervals of 0.50 without changing anything else. When I changed the share price from $45.5 to $46, the Call option value actually decreased from 0.4556 to 0.4444. Am I doing something wrong? Please see my input/output below.

Input:

Strike Price = 47.5

Share Price = 45.5

Time to expiration = 45 days

Volatility% = 16

Annual interest rate = 4.885

Output:

Option Value = 0.4556 (calls)

Input:

Strike Price = 47.5

Share Price = 46

Time to expiration = 45 days

Volatility% = 16

Annual interest rate = 4.885

Output:

Option Value = 0.4444 (calls)

Input:

Strike Price = 47.5

Share Price = 46.5

Time to expiration = 45 days

Volatility% = 16

Annual interest rate = 4.885

Output:

Option Value = 0.8 (calls)

Thanks,

Sreeni

Posted by Anonymous |

9/04/2006 02:35:00 PM

Anonymous |

9/04/2006 02:35:00 PM

In response to the question about the Pricing & Volatility Trading Room, it is offered Monday Mornings in the Advanced Options Trading Rooms Line-up. You will find it in the claendar under session 3, which is debit spreads.

Posted by Option Addict |

9/05/2006 08:08:00 AM

Option Addict |

9/05/2006 08:08:00 AM

kobe shoes

coach handbags

hermes handbags

bape hoodie

hermes

kyrie 5

supreme clothing

yeezy shoes

yeezy boost

michael kors bags

Posted by yanmaneee |

8/31/2019 11:10:00 AM

yanmaneee |

8/31/2019 11:10:00 AM