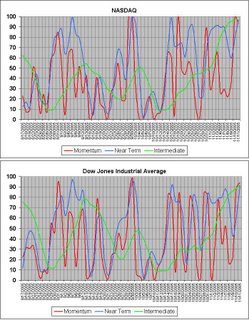

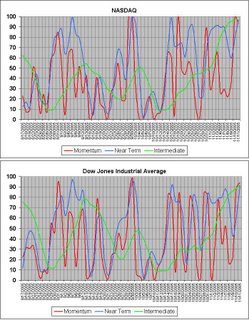

The market is approaching resistance and we are getting a bearish signal from the forecast as shown. Since we are in bullish trades as it is, this means we might want to start adding to a bearish watchlist. I am not very bearish on the market, but I think it might be appropriate for the market to pull back just a little over the next 1-2 weeks. In fact, as a homework assignment, look at a chart of the Dow over the last 5 years and look and see what happens to the market this time of year. Consumers are walking into stores and spending money. By the way, this is good for the market. Also look at the Market Forecast "Historical Graphs" and see what the forecast signaled around this time last year. My true bear signal will be for the Green line to cross below the 80 line, confirming a pullback. However, I have bullish and bearish trades I will be placing Monday morning, since I am neutral on the market at this moment. It could either breakout or turn down, right?Here are the trades I will make, they are as follows...

Bearish

LLY Dec 50 Puts @.80

Bullish

PD Dec 135 Calls @2.10

Watchlist Bullish

AAPL, ACL

Watchlist Bearish

ACV, GCI, SPW, SSP

PD shows a pennant breakout with enormous volume, this is the reasoning behind this trade. It's implied volatility was sky high and rising so this is why I chose an OTM option. I will get small time value and a high vega. On LLY, the stock is already in a downtrend, looks to be turning down from a recent peak. ATM option seemed appropriate since time value was cheap in this option. I am unsure just how far down this might go, so again, we will evaluate these trades along with our others on a daily basis. Check back to see how these trades evolve.