Conspiracy?

So I pull into a local gas station and start to pump gas. To my astonishment, the price at the pump is $2.85! Why on earth is Utah charging $2.85 for gas? Apparently 3 out of 4 major refineries are slow or under maintenance. Can anyone tell me why this is my problem?

Gas has dropped nearly $20 per barrel and I have only saved .06 per gallon. This is ridiculous. Gas was stuck at $2.91-$2.95 for the last year and now with prices declining and forecasted to continue, I am appalled that my local gas station is sticking it to me like this. This morning I decided to fight back. To hedge myself from being assulted at the pump, I bought puts on UPL this morning. There was a nice break of support at $45 and looking at the long term chart, you can see the lower high/lower low effect taking it's toll. Plus, you know how I love breakouts.

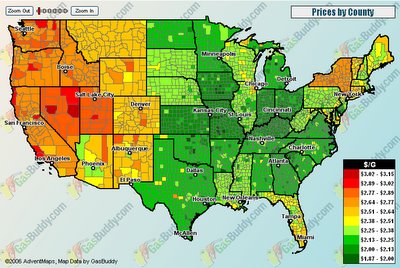

Curious to see what the rest of the country is paying for gas compared to you? Take a look at this nifty chart I found....

You show them, Jeff!!! Make 'em pay!!!! BTW, around $2.05 out here in the midwest (southern indiana)....

Posted by Travis Roy |

9/25/2006 12:43:00 PM

Travis Roy |

9/25/2006 12:43:00 PM

Jeff,

Was it a pennant breakdown you saw on UPL?

Posted by Anonymous |

9/25/2006 12:57:00 PM

Anonymous |

9/25/2006 12:57:00 PM

Sorry to disappoint Brett. No pattern here, just a break of support.

Posted by Option Addict |

9/25/2006 03:15:00 PM

Option Addict |

9/25/2006 03:15:00 PM

Here is another couple of ideas for topics on the blog: Put:Call Ratios

I get the CBOE market stats at the end of the day. Not really sure how to use the data though.

Also, do you ever fix/roll trades, as in turning a bad call trade into a bear call spread. This really seems like it work on trades if you are already buying OTM options and trade breakout suddenly reverses.

Posted by Anonymous |

9/25/2006 04:37:00 PM

Anonymous |

9/25/2006 04:37:00 PM

Yes, fixing trades by turning them into spreads or otherwise would always be of interest.

Thanks as always

Posted by Anonymous |

9/25/2006 07:04:00 PM

Anonymous |

9/25/2006 07:04:00 PM

$1.96 in Central IA. I guess we are one of the dark green squares on the map!

Posted by Anonymous |

9/25/2006 07:53:00 PM

Anonymous |

9/25/2006 07:53:00 PM