FFIV Analysis

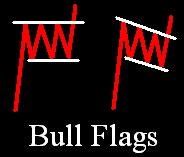

The angle of the flag will either be horizontal or a downward sloping diagonal angle. Similar to looking at a flag outside. On normal instances, the flag outside my building here will look like the example on the right. On very windy days, it will look like the example on the left. But I have never seen it look anything different than these two examples. I think FFIV is attempting to follow the outline on the left. This just means we need a close above $68 with volume to confirm this pattern.

The biggest red flag (no pun intended) on this example was the lack of volume on yesterdays price movement. It alone should have provided reason to not take this trade. Keep this on the watchlist and I will follow up as soon as we see a signal. One way or another. Thanks for everyone's participation on this. Great comments and analysis.

Red Flag? Time to wave the checkered flag!!!!

Posted by Anonymous |

11/09/2006 10:49:00 AM

Anonymous |

11/09/2006 10:49:00 AM