I'm taking time to write this post and hopefully enlighten your understanding of this wonderful concept. Before I get started let's define the subject for a more objective analysis.

Implied Volatility: In financial mathematics, the implied volatility of a financial instrument is the volatility implied by the market price of a derivative based on a theoretical pricing model. Or in easy terms, the expected volatility.

If I imply that the market will rise tomorrow, doesn't this mean I am expecting the market to rise? If a stock has high implied volatility, is the market expecting the stock to become increasingly volatile? The answer is yes. In the pricing of an option, volatility has a HUGE impact on how your option is priced. If volatility is high, the premium on the option will be relatively high, and vice versa.

Before we continue we need to discuss the correlation between historical and implied volatility. I shriek when someone tells me how the over/under evaluation suggests an option is over or under valued. Interestingly, the implied volatility of options rarely corresponds to the historical volatility (i.e. the volatility of a historical time series). This is because implied volatility includes future expectations of price movement, which are not reflected in historical volatility.

Implied volatility also is inaccurate due to the fact that in the US and Europe, many listed options have a market place where there is a 2-sided market with a bid (where you can sell and a marketmaker can buy) and an offer or ask (where you can buy and a marketmaker can sell). Therefore if someone buys an option on the offer the implied vol is higher for the same option than if it trades as if sold on the bid.

So thus far, we know that rising implied volatility causes options (calls

and puts) to increase in value. We also know that falling implied volatility causes options (calls

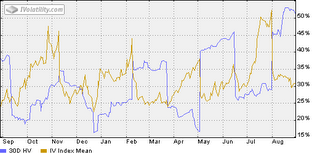

and puts) to decrease in value. Have you ever noticed the link on the right hand side of my blog that says "CBOE." It is there to get you implied volatility data. Click on that link, and enter your stock symbol on the left hand side. (BTW- The new toolbox will have this function on the upcoming release of the new toolbox.) When you enter your symbol, over on the right column, click on the thumbnail that says "Volatility Chart." You should see something like this...

This chart graphs two things. Implied and historical volatility. Like I mentioned earlier, there is no intelligent reason to compare the two. The future will normally always be priced higher than the past, so bet on it. What you can do here with my example on WFMI is watch that orange colored line rise and fall. This leads to the four steps I mentioned.

This chart graphs two things. Implied and historical volatility. Like I mentioned earlier, there is no intelligent reason to compare the two. The future will normally always be priced higher than the past, so bet on it. What you can do here with my example on WFMI is watch that orange colored line rise and fall. This leads to the four steps I mentioned.

#1. What is the relative high that volatility reaches?

Just like finding resistance on a stock, how high does implied volatility on WFMI get? About 45-50%? This is relatively high for this stock. When I see volatility is relatively high, it means the options are relatively expensive.

#2. What is the relative low that volatility reaches?

Just like finding support on a stock, how low does implied volatility on WFMI get? About 25%? This is relatively low for this stock. When I see volatility is relatively low, it means the options are relatively cheap.

#3. Is volatility rising?

As volatility increases, for instance before an earnings announcement...the price of options gradually increase. Why? Because you are expecting the stock to move more once earnings are released. Do you think that the chart above is magical the way it peaks about every three months???

#4. Is volatility falling?

As volatility decreases the price of the options will lose their value. Of course, not intrinsic value...their time value will get smaller. IMPORTANT: Volatility only impacts the time value of your option. If you trade ATM or OTM options, these will be heavily influenced by volatility.

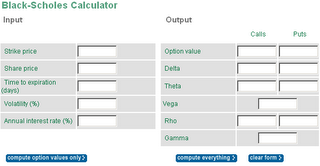

In closing, I hope your understanding is that ideally you want to buy options when volatility is low and starting to rise. Or if volatility is high and starting to fall, you want to sell. Also remember that when volatility is high, you might want to see why expectations are high. Perhaps earnings, judgments, FDA approvals, etc. Listen to my class on Monday mornings to go over various examples, or run over to the black scholes calculator and start inputting parameters. Change volatility numbers based on relative highs and lows.

Last comment and I am going home. How many times did I use the word "relative?" Every stocks volatility is different. For example, WFMI was as high as 50%...that might be another stocks low. Every issue is different. Remember it's not the value, but where the value has been, and where it is going.

I kick major ass for writing this tonight(patting myself on the back). See you tomorrow.

trading account I stumbled across some interesting results. Gold stocks cleaned up today. Click here to see the 1 day returns for the gold & silver mining stocks today. For a ho-hum day in the market, I was impressed to see Gold rally so well. A little good news in a group goes a long way doesn't it?

trading account I stumbled across some interesting results. Gold stocks cleaned up today. Click here to see the 1 day returns for the gold & silver mining stocks today. For a ho-hum day in the market, I was impressed to see Gold rally so well. A little good news in a group goes a long way doesn't it?

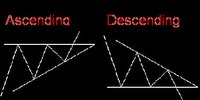

Re-Tests- After a breakout, it is not uncommon to see the price rally back to the area it broke out of. Here is a another picture that shows the stock above after the initial breakout, rally back up to old support and use it as new resistance. This is called a re-test. Re-tests are great entry points if you missed the breakout. Volume is not as important on the re-test as it is on the breakout.

Re-Tests- After a breakout, it is not uncommon to see the price rally back to the area it broke out of. Here is a another picture that shows the stock above after the initial breakout, rally back up to old support and use it as new resistance. This is called a re-test. Re-tests are great entry points if you missed the breakout. Volume is not as important on the re-test as it is on the breakout.  Pattern Failure- After a breakout, if the price ever traces back within the body of the pattern before reaching a target, this is considered a failed pattern. Also, if the stock breaks out in the wrong direction this is a failed pattern as well. (Ex: If I am watching an ascending triangle and the stock breaks support instead of resistance.) If either scenario happens, I take the loss and move on. Here is an example of a failed pattern.

Pattern Failure- After a breakout, if the price ever traces back within the body of the pattern before reaching a target, this is considered a failed pattern. Also, if the stock breaks out in the wrong direction this is a failed pattern as well. (Ex: If I am watching an ascending triangle and the stock breaks support instead of resistance.) If either scenario happens, I take the loss and move on. Here is an example of a failed pattern.

This chart graphs two things. Implied and historical volatility. Like I mentioned earlier, there is no intelligent reason to compare the two. The future will normally always be priced higher than the past, so bet on it. What you can do here with my example on WFMI is watch that orange colored line rise and fall. This leads to the four steps I mentioned.

This chart graphs two things. Implied and historical volatility. Like I mentioned earlier, there is no intelligent reason to compare the two. The future will normally always be priced higher than the past, so bet on it. What you can do here with my example on WFMI is watch that orange colored line rise and fall. This leads to the four steps I mentioned.

When using this tool, I will draw my lines staring from the extreme bottom (Sept of last year) and pull them up to my extreme high (Dec of last year). Your time frame can be intra day movements or longer term movements, it all depends on what your time horizon is. The application remains the same of how to draw them. The Fibonacci lines will seem to fall around congestion points for the stock price. The lines tend to catch the tops and bottoms of price movements. These are helpful especially if the stocks support or resistance areas correlate to these lines. It makes them more potent. If you look recently at the highs & lows of WFMI, the last bottom happened to reach the 78.6% line and the recent high at the good ol' 61.8% line. If the stock turns down from this line, perhaps another drop down to the 78.6% line can act as a target price? Without using Fibonacci lines, $47 was my initial target price. This indicator just enhances the likelihood of this outcome.

When using this tool, I will draw my lines staring from the extreme bottom (Sept of last year) and pull them up to my extreme high (Dec of last year). Your time frame can be intra day movements or longer term movements, it all depends on what your time horizon is. The application remains the same of how to draw them. The Fibonacci lines will seem to fall around congestion points for the stock price. The lines tend to catch the tops and bottoms of price movements. These are helpful especially if the stocks support or resistance areas correlate to these lines. It makes them more potent. If you look recently at the highs & lows of WFMI, the last bottom happened to reach the 78.6% line and the recent high at the good ol' 61.8% line. If the stock turns down from this line, perhaps another drop down to the 78.6% line can act as a target price? Without using Fibonacci lines, $47 was my initial target price. This indicator just enhances the likelihood of this outcome.