PCAR Update

It has been about a month or so since I last touched on the topic of Implied Volatility. Last week we talked about credit spreads, and today I am in the mood to merge the two topics together. I have heard many traders say that they pick a trade based on the implied volatility of the underlying. Touché. At the same time I hear others try to generalize strategies saying that if Implied Volatility is high (options are expensive) then you want to be an option seller (credit spreads). If Implied Volatility is low (options are cheap) then you want to be a buyer (debit spreads). Let's go through an example. Assume I was going to sell a bull put spread on Apple Computers: AAPL. Let's really examine this trade closely. Keep in mind Apple was at 91.00 at the time of this post.

It has been about a month or so since I last touched on the topic of Implied Volatility. Last week we talked about credit spreads, and today I am in the mood to merge the two topics together. I have heard many traders say that they pick a trade based on the implied volatility of the underlying. Touché. At the same time I hear others try to generalize strategies saying that if Implied Volatility is high (options are expensive) then you want to be an option seller (credit spreads). If Implied Volatility is low (options are cheap) then you want to be a buyer (debit spreads). Let's go through an example. Assume I was going to sell a bull put spread on Apple Computers: AAPL. Let's really examine this trade closely. Keep in mind Apple was at 91.00 at the time of this post.

Personally, I am not totally sold on the fact that the market has up and changed direction. Yes, today's price has violated a trendline or two, but as I am trying to figure out what will happen tomorrow, I'm not entirely sure that this is going to continue. I figure if we are going to have some type of year-end rally, this had to occur before we can make an advance. Anyone agree? How about disagree?

Personally, I am not totally sold on the fact that the market has up and changed direction. Yes, today's price has violated a trendline or two, but as I am trying to figure out what will happen tomorrow, I'm not entirely sure that this is going to continue. I figure if we are going to have some type of year-end rally, this had to occur before we can make an advance. Anyone agree? How about disagree?

I am still in the process of completing my weekly watchlist review. I am dragging tail this morning. It was so nice to be away for the last four days and finding it hard to get back in my rhythm. As soon as I get my list together, we'll talk trades.

Let's examine the evidence. It recently broke $500. Where is it going? Can you say we have a target price on this one? If you were trading the recent flag, this would give you a target of about $525...and I don't see an option that will surrender a decent enough profit for the risk involved. Based on the price of these options you need to swing short & fast, meaning a front month or second month out option along with an aggressive strike. The problem I have with this is that I think Google will test 500 again before moving too much higher. You will then get stuck with melting time (expensive melting time I meant).

Let's examine the evidence. It recently broke $500. Where is it going? Can you say we have a target price on this one? If you were trading the recent flag, this would give you a target of about $525...and I don't see an option that will surrender a decent enough profit for the risk involved. Based on the price of these options you need to swing short & fast, meaning a front month or second month out option along with an aggressive strike. The problem I have with this is that I think Google will test 500 again before moving too much higher. You will then get stuck with melting time (expensive melting time I meant). I am starting off the day on a topic other than trading...we will get back to trading as soon as the market closes. For this post I want to know how you are going to cook your turkey this year? What is the special receipe you are willing to share? I have been talking with a few people on how they are going to prep their turkey this year and am looking to see what the masses approve of when roasting their bird.

I am starting off the day on a topic other than trading...we will get back to trading as soon as the market closes. For this post I want to know how you are going to cook your turkey this year? What is the special receipe you are willing to share? I have been talking with a few people on how they are going to prep their turkey this year and am looking to see what the masses approve of when roasting their bird. Look at the chart below, and what is the best trade to make on this one. The stock is catching on fire and what trade could you place to take advantage of it? Yes, there are expensive options here...yes, it has moved a lot already, so what would you do if you had to trade it?

Look at the chart below, and what is the best trade to make on this one. The stock is catching on fire and what trade could you place to take advantage of it? Yes, there are expensive options here...yes, it has moved a lot already, so what would you do if you had to trade it?

The Engulfing Pattern

The Engulfing Pattern The Shooting Star

The Shooting Star The Harami

The Harami I hate to admit, but yes I did close out on LVS today. Since I was not near my computer I had a stop in at $8.00 and I was stopped out. It was unfortunate to see this one end, but this was all I wanted to risk on this trade. Luck would have it that it will likely rally strong tomorrow on a good CPI report. Ah well... a 8.00 on a 1.50 investment is not bad. I hope you all enjoyed this gem we discovered last week. Nice work!

I hate to admit, but yes I did close out on LVS today. Since I was not near my computer I had a stop in at $8.00 and I was stopped out. It was unfortunate to see this one end, but this was all I wanted to risk on this trade. Luck would have it that it will likely rally strong tomorrow on a good CPI report. Ah well... a 8.00 on a 1.50 investment is not bad. I hope you all enjoyed this gem we discovered last week. Nice work! In regards to the comments, I love the fact that we have so many comments from all the readers. Your participation illustrates to the group the different levels of traders we have. As you continue to contribute, I would like to ask that you leave your name with comments. At least a first name below your comment will give an entity to address if I or others would like to respond. So let's set a new "Blog Law" today. No more anonymity? Is that a word?

In regards to the comments, I love the fact that we have so many comments from all the readers. Your participation illustrates to the group the different levels of traders we have. As you continue to contribute, I would like to ask that you leave your name with comments. At least a first name below your comment will give an entity to address if I or others would like to respond. So let's set a new "Blog Law" today. No more anonymity? Is that a word?

Isn't it pretty? Does it look confusing? Do not be intimidated. Once you know what is going on here, it becomes easier to digest. Typically a DMI is calculated using two lines, but as you can see the interactive chart offers three lines...

The ADX (Average Directional Index)

+DI (Positive Directional Indicator)

-DI (Negative Directional Indicator)

The ADX is simply a moving average of the DMI, so your many use it as opposed to the DMI. For those that use the DMI, they are giving more credence to the +DI and -DI lines. Like I mentioned, the +DI is measuring positive movement, and -DI measures negative movement. In a situation like you see in my graphic, where the positive crossed the negative last month, this indicates a buy signal and when negative crosses over the positive this creates a sell signal. By the way this indicator is used on a scale of 0-100. When you take these buy and sell signals in conjunction with the ADX, as the ADX is heading higher this means the market is in an uptrend mode and this amplifies the buy and sell signals. If the ADX is low or flat, this means the buy signals would be dampened because the market is not trending.

When I first studied the DMI I found the premise to be fascinating. Since stocks are considered to trend only about 30% of the time, and 70% they are non-trending, most system traders need to know when to switch from a trending system to an oscillating system. For example, years ago when I thought system trading was "IT" I traded a moving average crossover system. Works great when things trend and is annoying as hell when things do not trend. Had I been applying a DMI back then I might have seen signals that trends might possibly cease and eliminate trading through the sideways times.

There are too many indicators out there to name, but they all try to do the same thing. They try to calculate price movements. As I have realized this over the last years, I have started to try and accomplish the same thing. Try to study price movements.

I hope this was helpful. Like I said, I had 20 minutes to put this together. As always Wednesdays are tough for me, but I hope I have kept you entertained. Tomorrow is Thursday "Blog" Day and I have lots of things we can do. See you then.

Yesterday's Marketcast didn't update on the toolbox. Since I received a ton of e-mails over night about this, and our main tech guy that fixes our server when this happens in on vavation. Until we get that corrected, click here if you want to listen to our Marketcast as of yesterdays close. I still hope to add my own commentary to this site, but until I get the appropriate software and tools it is on hold.

Yesterday's Marketcast didn't update on the toolbox. Since I received a ton of e-mails over night about this, and our main tech guy that fixes our server when this happens in on vavation. Until we get that corrected, click here if you want to listen to our Marketcast as of yesterdays close. I still hope to add my own commentary to this site, but until I get the appropriate software and tools it is on hold.

Assume that you took this trade on the breakout Wednesday. Also assume that you bought the December 85 calls at $1.50 per contract, and as of right now they are trading at $5.80 per contract. What would you do here?

Actually, I know exactly what you would do here, but I want all of you to send comments about what action you would take and why? Exits are the best conversation piece.

Back to hedging. Brett asked how do I do this in my account. To give a simple response I diversify. As an option trader this means to not only take a bullish stance on the market, but to take a bearish stance as well. I never trade 100% with the market. I always look for a few trades I can take on weak stocks. In case I am wrong on the direction of the market, it is nice to have positions that will benefit in this instance. As usual, if the market were bullish, I would find weak groups, weak stocks and pick up a few puts.

Back to hedging. Brett asked how do I do this in my account. To give a simple response I diversify. As an option trader this means to not only take a bullish stance on the market, but to take a bearish stance as well. I never trade 100% with the market. I always look for a few trades I can take on weak stocks. In case I am wrong on the direction of the market, it is nice to have positions that will benefit in this instance. As usual, if the market were bullish, I would find weak groups, weak stocks and pick up a few puts.

An interesting comment came out on the Q&A last night. As we looked at LVS, which broke it's resistance at $78, and was trading at $79 and some change. The "Is it too late" question surfaced, and I had the opportunity to talk about breakouts, and how typically the stock will retrace to old support. With the price sitting about a buck and a half away from support would you have risked a buck and a half on this trade to see it move higher? Essentially this is what your risk is. If the stock closed below support today, I would have taken the beating and went about my business.

An interesting comment came out on the Q&A last night. As we looked at LVS, which broke it's resistance at $78, and was trading at $79 and some change. The "Is it too late" question surfaced, and I had the opportunity to talk about breakouts, and how typically the stock will retrace to old support. With the price sitting about a buck and a half away from support would you have risked a buck and a half on this trade to see it move higher? Essentially this is what your risk is. If the stock closed below support today, I would have taken the beating and went about my business.  If you missed last nights presentation, I conducted a trader interview with Eric Utley, who is one of our content writers/developers here at INVESTools, and a phenom of a trader. I always enjoy his perspectives and insight, hopefully you got something from this as well.

If you missed last nights presentation, I conducted a trader interview with Eric Utley, who is one of our content writers/developers here at INVESTools, and a phenom of a trader. I always enjoy his perspectives and insight, hopefully you got something from this as well.  Tonight I will be competing against the Trading Psychology Open House. I should have been teaching this open house, but there was an obvious conflict with my obligations as a Master Talk instructor. However, I hope tonights class rivals the opposition. I have another interactive presentation planned for tonight. I hope to see those of you with access to this class later tonight. I will be teaching Session 2 again.

Tonight I will be competing against the Trading Psychology Open House. I should have been teaching this open house, but there was an obvious conflict with my obligations as a Master Talk instructor. However, I hope tonights class rivals the opposition. I have another interactive presentation planned for tonight. I hope to see those of you with access to this class later tonight. I will be teaching Session 2 again.

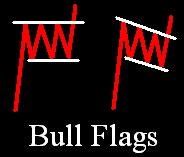

The angle of the flag will either be horizontal or a downward sloping diagonal angle. Similar to looking at a flag outside. On normal instances, the flag outside my building here will look like the example on the right. On very windy days, it will look like the example on the left. But I have never seen it look anything different than these two examples. I think FFIV is attempting to follow the outline on the left. This just means we need a close above $68 with volume to confirm this pattern.

The biggest red flag (no pun intended) on this example was the lack of volume on yesterdays price movement. It alone should have provided reason to not take this trade. Keep this on the watchlist and I will follow up as soon as we see a signal. One way or another. Thanks for everyone's participation on this. Great comments and analysis. roll in yesterday about this question. Not to mention one of the most active contributors to this blog, "Brett" wrote a piece around this a couple weeks ago. If you have not read this, click here.

roll in yesterday about this question. Not to mention one of the most active contributors to this blog, "Brett" wrote a piece around this a couple weeks ago. If you have not read this, click here.

I looked at my hit counter today, and it looks like this blog has surpassed the 100,000 hit mark over the weekend. That is HUGE! Thank you to all of you for making this a site that you check regularly.

I looked at my hit counter today, and it looks like this blog has surpassed the 100,000 hit mark over the weekend. That is HUGE! Thank you to all of you for making this a site that you check regularly.

Find new trades

Manage existing trades

Lunch

Update/Purge List

Revisit Stops & Position Size

Market Review

This image is a commodity, since the only people who can get access to this tool is through the Active Investor program. This means you would need to come to Utah for the 4-day live class, and then you are given access to this tool. You cannot purchase this tool from prophet individually, even if you pay for their platinum package. It is reserved for only the elite students!

Anyhow, if you look at this page it is a search engine designed to look specifically look for patterns. If you want to find triangles, wedges, channels, topping or bottoming formations, this is your ticket to easy pattern recognition!

You can classify which pattern you want to find, how recent the breakout was, or if it has not happened yet. You can set the timeframe in which it took to form, specify continuation or reversal, and the patterns are ranked on different strength indicators...basically meaning you can sift through many to find the more dynamic patterns. The target prices they establish are amazingly accurate. They have a proprietary algorithm to set their target and you would be surprised how many reach this destination.

Going back to the question..."do I use this, and have I been successful with these trades"... yes, and yes. I must be honest though. My preference is to use watchlists to look for patterns. This way I can control the type and quality of stocks that I find patterns in. When I first used this tool I had made the comment that "this is as close a computer can get to performing magic." I was blown away by the capabilities and results. I still am blown away by it, but my preferences and pickiness has led me back to my watchlists more often...but since I teach the Price Patterns class each week, and some weeks there are not any patterns I can find, I go back to this old reliable tool to help me do the work.

In your position, look at it this way. Obviously I have trained my eyes to find these a lot quicker than the norm. It literally takes me 30 minutes to look through 1800 thumbnail charts each week. It might take someone just learning patterns a full week to do this. At this point I would recommend it to users who want to find things quickly. Then you can sort through all the patterns to find the quality and types of stocks you want to find patterns in.

This was probably longer than it needed to be, but a good question nonetheless. Thanks!

Did you know I love retail stocks right now? I have been touting these for the last two months or more. Many had nice trends that offered great profits. Many have been stopped out recently. Take a look at the S&P Retail Index $RLX or RLX.X. You can see today that we are moving below our prior low. What do lower lows represent? Thats right...panic.

Did you know I love retail stocks right now? I have been touting these for the last two months or more. Many had nice trends that offered great profits. Many have been stopped out recently. Take a look at the S&P Retail Index $RLX or RLX.X. You can see today that we are moving below our prior low. What do lower lows represent? Thats right...panic.

If the chart does not pull up when you click on it, type in symbol KSS. Are there any takers on this trade? What do you see and what would you do with this stock? If I get a minute later this evening, I will try to put in some more effort. Even though money never sleeps, life has a way of getting in the way of things.

See you later???

![]() Subscribe to posts and get Jeff's articles

delivered to you automatically.

Subscribe to posts and get Jeff's articles

delivered to you automatically.

![]() Subscribe to comments and

keep up with the addict community.

Subscribe to comments and

keep up with the addict community.

Need help? Learn about subscribing.